Content

- What Is the Best Accounting Software for Small Businesses?

- Best for Sole Proprietors and Very Small Businesses

- Sign up for your free trial today to grow your business and manage your accounting the easy way.

- Business Accounting Software FAQs

- Best Free Software

- The 5 Best Accounting Software for Small Businesses of 2023

Even the most bare-bones financial software should include features like invoicing, expense and income tracking, bank reconciliation, and mileage tracking. However, Xero’s $13 a month plan limits you to entering only five bills and sending only 20 invoices a month. You can send unlimited invoices and quotes with only the Growing and Established plans, which start at $37 and $70 a month, respectively. In contrast, both QuickBooks and FreshBooks offer small-business expense tracking up front. As a small business, you needaccounting softwarethat allows you to focus on your work without worrying about finances.

What Does Accounting Software for a Small Business Do?

Accounting software reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, transactions will flow into the accounting software, where they can be categorized into various accounts. While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly. For this reason, many businesses hire bookkeepers or accountants to maintain or review their books. Cloud-based online accounting software makes it convenient for businesses to access their books at the same time as their bookkeeper or accountant.

The most basic functions of accounting software for small businesses are:

Invoicing

Bank and credit card syncing

Accounts payable

Accounts receivable

Online payment collection from customers

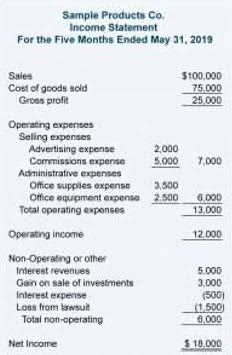

Basic financial statement preparation, such as profit and loss statements, balance sheets, and statements of cash flow

User… Ещё

Sage 50cloud Accounting is a powerful piece of software, so why didn’t it receive a higher rating? A dated interface, lack of mobile access, and the requirement to install the software locally keep it from receiving a higher score. To choose the best accounting software for small businesses, we looked at a variety of factors. First, we considered the features each software offers and how they can benefit small businesses. Next, we looked at the pricing of each software to see which ones are most affordable for small businesses.

What Is the Best Accounting Software for Small Businesses?

You communicate with a dedicated bookkeeper through one-way video chat (they can’t see you) or email. This individual and their team work with you on customizing your setup and monitoring your transactions so they’re accurately entered and categorized for tax purposes. They reconcile your accounts and close your books at month’s end to prevent errors. Plus, they’re available for questions during regular business hours.

FreshBooks accounting software allows you to set up a billing schedule to automatically charge your client’s credit business bookkeeping card in seconds. Plus, track your time on the job and collaborate with team members and clients with ease.

Best for Sole Proprietors and Very Small Businesses

You usually need to submit financial documents like profit and loss reports as part of your business taxes each year. Additionally, you need thorough documentation to secure a small-business loan or appeal to eventual shareholders. QuickBooks Onlineis definitely among the most popular accounting software for small businesses, and its thorough accounting features definitely make it the best accounting software for many users. Zoho Books has about as many features as QuickBooks at a lower price and a low additional user fee. Its free plan is perfect for freelancers who want solid reporting and financial tracking without any overwhelming bells and whistles (for instance, QuickBooks’ dozens of customizable reports).

- Most accounting software also syncs with payroll software so you don’t have to transfer your paycheck data into your general ledger by hand.

- We also have an extensive Help Center that has answers to just about every question we’ve ever been asked by our customers, with useful articles and information at your fingertips.

- Finally, we considered the ease of use and customer support for each software.

- When choosing accounting software, it’s important to consider the needs of your business and compare different features to find the best fit.

- Xero and Zoho Books go further, allowing you to produce more advanced forms, like purchase orders, sales receipts, credit notes, and statements.

- As a business grows, most software is scalable, and the plan can be easily upgraded to meet new business needs.

You can choose how frequently invoices are sent – daily, weekly, monthly or annually – and indicate whether there’s an end date to the billing. Plooto’s payment platform lets you manage payments, approvals, reconciliation and reporting from one central location. Xero isn’t as well known as some other accounting software, which may affect your accountant’s learning curve.

Sign up for your free trial today to grow your business and manage your accounting the easy way.

Freelancers should consider using accounting software that can generate invoices. Firms, freelancers and consultants who work with clients on projects or jobs should look for accounting software that helps them track their projects’ tasks and budgets.

What is the best accounting software for small business?

MarginEdge: MarginEdge is the best accounting software for restaurants because it offers a suite of features designed specifically for food service businesses. With MarginEdge, you can automatically import sales data and track your margins in real time by integrating with popular point-of-sale (POS) systems.

Zoho Books: Zoho Books offers the essential features that you need to manage your finances, such as issuing invoices, reconciling accounts, tracking expenses and generating reports. It also provides additional advanced features including project accounting and time tracking if you need them too.

FreshBooks: If you own a small business and don’t have an accounting background, FreshBooks is the software for you. With FreshBooks, you can easily create and send invoices, track expenses, manage projects and clients, and view reports.

Kathy Haan, MBA is a former financial advisor-turned-writer and business coach. For over a decade, she’s helped small business owners make money online. When she’s not trying out the latest tech or travel blogging with her family, you can find her curling up with a good novel. These include NCH, Zoho Books, Kashoo, ZipBooks, Sunrise, GnuCash, TrulySmall Invoices and Wave Accounting. Today’s leading accounting platforms offer standard security features such as data encryption, secure credential tokenization and more.

Business Accounting Software FAQs

Free software usually offers fewer features than paid software, so we recommend it primarily to freelancers, solopreneurs, and businesses with few employees. Bigger businesses should plan on spending quite a bit more per month—or even on outsourcing to a virtual accountant. If you want fully featured accounting software with an excellent app, clean dashboard, and affordable price, we recommend Xero. Based on its features and pricing alone, it’s a great bookkeeping and accounting company for most business types, from freelancers to LLCs.

Both the Growing and Established plans offer unlimited invoices and bills. The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. Wave Accounting is the best free accounting solution for most freelancers, contractors, and other small-business owners. While it has fewer financial reports than other accounting systems, it’s perfect if you juggle multiple businesses, want to add multiple users, or need unlimited expense tracking.

Best Free Software

Activate the accounting software’s default settings or customize your own terms and message. Automate tasks like organizing expenses, tracking time and following up with clients, FreshBooks accounting software works hard for bakers, so they can rest easy. The right software helps business owners quickly categorize transactions and generate financial statements. These include cash flow reports, balance sheets, profit and loss statements, and expense breakdowns.

Uncomplicated navigation, an attractive, intuitive UI, and exceptional mobile access add to its appeal. It’s missing some features that competitors offer, and it includes some language and concepts that rivals keep in the background, but it’s a solid, inexpensive solution. Wave is for sole proprietors and freelancers who need an online accounting service and may want a little room to grow. Integrated payroll and double-entry accounting support make it a potential option for small businesses with a few employees, though there are better choices for those companies. And because it has a simple user interface, even financial novices could use it.