These companies record their current construction projects as « construction in progress. » The construction in progress value reflects the total costs incurred to date. NetSuite financial management software automates everyday accounting and handles the unique requirements of the construction industry. It provides real-time access to information from across the company, whether users are in the office or out on project sites. It handles fixed-price, time and materials, cost plus and unit pricing contracts and automates revenue recognition to help companies comply with ASC 606 and specific tax requirements.

DEADLINE ALERT for S, TIO, and DOYU: The Law Offices of Frank … – GlobeNewswire

DEADLINE ALERT for S, TIO, and DOYU: The Law Offices of Frank ….

Posted: Tue, 01 Aug 2023 15:29:00 GMT [source]

That way, management can see problems before they occur and make adjustments as necessary — like securing short-term financing or re-evaluating upcoming projects. All of these factors can lead to irregular cash flow cycles and difficult financial management for construction companies. As a result, accurate accounting and careful financial analysis is essential for construction businesses to stay sustainable and grow. Under the completed contract method (CCM), contract income isn’t reported until the project finishes. Of course, that doesn’t mean there aren’t expenses during construction or that contractors can’t bill in the meantime. This sometimes means contractors are able to defer taxable revenue if the contract won’t be completed until the following tax year.

Companies that build and manage properties may maintain separate CIP accounts for each property under development to facilitate the tracking of project expenses. Accurately tracking costs, revenues, and other financial data creates a foundation for companies to grow and stay cash flow positive. Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives to allocate financial resources efficiently.

Construction Accounting vs. Regular Accounting: What’s the Difference?

Unlike other businesses, construction companies have to manage other anomalies like job costing, retention, progress billings, change orders, and customer deposits. These extras make CIP or construction in progress accounting relatively more complicated than regular business accounting. There are many perks to using software, such as automated job costing, better financial tracking, and workers in the office and field having instant access to files like timecards and change orders. Depending on the software, it can also include security and auditing features to help avoid risks. Overall, utilizing a software with accounting integration can help to improve the speed and accuracy of your reports.

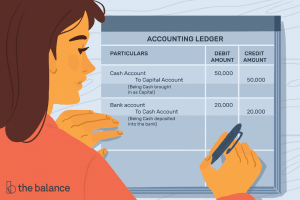

Job costing creates a powerful cycle where previous financial data leads to better financial decisions in the future. The most important thing for contractors, whether experienced in the industry or just starting out, is to have help. A construction payroll service that can handle multiple states, unions and certified payrolls can save a tremendous amount of time. And integrated job cost accounting software is incredibly important for contractors who outgrow small business software like QuickBooks® and need more robust reporting. In addition to the fundamentals of general accounting, like debits, credits and financial statements, contractors have many additional aspects they have to manage and account for. Job costing helps stay on top of the numerous variables of running a project-centered, decentralized business.

Importantly, the income sheet’s view of profit must match the change in equity reflected on the balance sheet. Liabilities are a company’s financial obligations, which include both short-term and long-term debt. Since 15 percent of the expected costs have been incurred, the company will also recognize 15 percent of the expected revenue and expected profit on its books. Cash accounting is the simplest and most straightforward approach to tracking finances, but it’s also the most limiting.

Example of Construction Work-in-Progress

You can’t evaluate each of the projects based on their respective percentage of progress against the corresponding direct costs and determine overall production for the company. Furthermore, by comparing the aggregated dollar value of all projects and comparing this amount to the unpaid direct costs you can evaluate your overall cash flow needed to facilitate further production. With this information and understanding of the auxiliary information I provide you should begin to appreciate the relationships CIP provides to the other areas of the financial reports. In period two, the contractor did set the tile but at month’s end has not mounted the base for the vanity as it now has been purchased and is in the garage to prevent damage while awaiting installation. Again, the contractor does not assign any percentage of completion to this step in the contract and therefore does not transfer any costs of installing the vanity to the profit and loss statement.

It’s designed specially to help contractors track each job and how it affects the company as a whole. While it draws on all the same basic principles of general accounting, it also has several important and distinct features. Construction accountants manage, analyze and update a construction firm’s financial information. Because these firms are generally project-based, much of the accounting team’s work focuses on job costing tasks required to estimate, track and analyze project expenses. Applying best practices for construction accounting can deliver benefits across the entire business. Accurate job costing, for example, can help businesses see where they’re making or losing money and react quickly before profitability is negatively impacted.

A contract may include a single performance obligation, or it may include several. Contractors must identify performance obligations in the contract and allocate a price to each. Construction firms — especially those undertaking large-scale projects like commercial or municipal buildings — may win only a few contracts per year. Thus, a typical chart of accounts for a contractor will look different from a manufacturer or high-volume retail or hospitality business. Sales staff will also be remunerated differently, and accounting needs to pay significant attention to the financial health of customers. Continuously fluctuating direct and indirect costs make it difficult to estimate project expenses.

Learn How NetSuite Can Streamline Your Business

However, you must know that the nature of costs and revenues in every construction contract varies. After the construction has been completed, the relevant building, plant, or equipment account is debited with the same amount as construction in progress. After the completion of construction, the company will record depreciation on the asset. Lenders providing permanent financing base the loan value on the balance shown in the CIP account.

If, for example, a WIP report shows that a project is 30% complete but has used up 70% of its budget, you can likely predict it’ll go over budget. As such, this encourages a more proactive than reactive approach to project management allowing companies to take action before it is too late. In most cases, the term of process or progress can be used interchangeably. However, there are chances that the term process written in a financial statement instead of progress indicates the business nature. I most often would get that the project is 20% complete and thus we have only earned about $40,000 of the $200,000 contract and have spent $42,000 to date. I need to investigate and usually it’s a simple matter of looking at the details in the CIP account of all the bills we have received and their corresponding function.

Construction-in-Progress (CIP) Report

For instance, if a cement manufacturing company is expanding the manufacturing unit. It will use cement from its own inventory, therefore, debiting the inventory account. – Managing CIP accounts require proper knowledge, experience, and advanced bookkeeping tools.

Therefore the balance sheet CIP account has this accumulated value sitting in this project’s account. Companies that don’t track CIP costs accurately and separately make their records more complicated than they need to be. Mixing CIP projects with others create a hazy picture of business finances as it indicates that a company is generating expenses that are producing zero profits. Thus, to keep things simple and the balance sheet balanced, it is best to keep them separate. The cip account is basically just an account for recording all the different expenditures that will occur during a construction project.

Nemetschek SE: First Half of 2023 on Plan – Continued Strong … – NEMETSCHEK

Nemetschek SE: First Half of 2023 on Plan – Continued Strong ….

Posted: Mon, 31 Jul 2023 05:28:04 GMT [source]

However, as the company expands, recruits more employees, and works simultaneously on multiple projects, tracking transactions on a spreadsheet gets difficult and time-consuming. Our knowledgeable team has decades of experience managing construction company accounts, and you can feel confident that we will navigate your company’s specific situation with care and expertise. Construction in progress accounting is also a prime zoho books review target for auditors due to the length of time the account can be left open. Because companies can store costs under the account for extended periods of time, they can avoid depreciation, therefore reports could have profits listed at a higher value than they really are. Brittney Abell joined Procore after 6 years as an accounting manager for a commercial general contractor, overseeing accounts payable and receivable.

For instance, you may assume that a project is 60% complete simply by comparing the costs to date with your estimated budget. While you may have spent 60% of your budget, the work could be only 40% finished. You can then calculate the over under billing by subtracting the earned revenue to date from the (total amount billed minus the total cost to date).

Depending on the project’s size, construction work-in-progress accounts can be some of the largest fixed asset accounts in a business’s books. Many construction companies will repeatedly use the same type of contract for similar projects, and over time these businesses grow in their ability to monitor job costs, revenues, and profit. On top of that, construction contracts often include retainage — a portion of the payment that is withheld until the entire project is complete. That means a contractor’s profit margin may be held back long after their portion of the work is complete. In the end, construction companies have one way to control costs and bid intelligently.

- One of these challenges is learning how to record construction in progress accounting.

- Given the unique financial challenges that construction businesses face, well-developed accounting processes are essential for executives to allocate financial resources efficiently.

- On top of distinct project requirements, construction also features long and often seasonal production cycles.

- Once the asset is placed in service and shifted to its final fixed asset account, begin depreciating it.

- In addition, contractors must pay attention to ASC 606 new revenue recognition standards.

Previously, she worked as a contract administrator for an architecture & design firm. She has worked on a variety of building projects, including travel stops, restaurants, hotels, and retail warehouses raging from $2M to $20M. A business with a quick ratio above 1 is regarded as liquid, meaning that it has enough cash resources to pay its current liabilities. Conversely, a business with a quick ratio below 1 does not have enough cash resources, so it will need to get an influx of cash through financing or by selling other long-term assets. Control is transferred when the constructed asset becomes the customer’s to own. If it’s on the customer’s land, the foundation of a building might come under the customer’s control as soon as it’s poured, the frame as soon as it’s put up, etc.

Contractors, however, need to treat each and every construction project as a unique, short-term profit center. What really makes this special is that each construction job tends to have unique inputs and requirements. Even when projects have similar production requirements, they’re often subject to different site conditions or local variables like labor availability, cost of materials and legislation. Plus, projects are continually opening and closing during the year with each contract.

Even somewhat repeatable projects require modifications due to site conditions and other factors. Where certified payroll typically tracks wage and fringe obligations for government agencies, union payroll needs to track and report wage and fringe obligations to the union local. For example, an HVAC technician paid at $20 an hour might be billed at a fixed $50 per hour. Additionally, the equipment they install might follow a standard markup table by item or price, such as “2x” for a disposable air filter. If the technician spent two hours on the dispatch and additionally replaced a $20 air filter, the contractor would bill the customer $100 for labor plus $40 for materials. To be eligible, contractors can’t exceed a certain average annual revenue and their contracts must be able to be completed within a set timeframe.