The annual limits for 2021 are $3,600 (self-only) and $7,200 (family), plus a $1,000 catch-up contribution. Any contributions to an HSA, IRA or Coverdell ESA, when made for the prior year through that year’s income tax-filing deadline, should be clearly indicated as such to avoid confusion. If these contributions are not marked for the prior year, the account’s custodian may report it as being for the current year. In addition, pharmacies and retailers must update their software systems to show that PPE products are now eligible for payment through tax-advantaged benefit accounts. Members may download one copy of our sample forms and templates for your personal use within your organization. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices.

Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards. The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses. This increases the risk on the company and workers, by increasing the chance that expired and inadequate PPE is being used, which can be catastrophic for health and safety as well as legal and financial issues. When a worker requires some PPE, they can simply open their mobile device, access the form, and complete the request. Once requested, the form is automatically sent to a designated person with the authority and power to purchase the PPE, who can then simply approve the order. PPE requests involve workers requesting specific PPE items, while PPE issues are the records which highlight when PPE was issued.

- Benefit account participants, however, « can submit manual claims with appropriate receipts, » he pointed out.

- Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission.

- Whether a portion of available cash is used, or the asset is financed by debt or equity, how the asset is financed has an impact on the financial viability of the company.

- PP&E may be liquidated when they are no longer of use or when a company is experiencing financial difficulties.

- Companies can also borrow off their PP&E, (floating lien), meaning the equipment can be used as collateral for a loan.

But it’s also a living database which indicates to companies when PPE needs to be replaced, or when new training is required. The PPE request form you see below is an example of a digital PPE request form which can be filled out and sent directly on site with a mobile or tablet. There are two main dimensions of PPE record keeping; one dimension is how PPE is ordered and requested and can be considered forward and backwards; the other dimension is the static and horizontal ‘storage’ of PPE records so that things can be looked back at and reconciled. Slow and delayed PPE records equate to delays in PPE issuing, over-issuing PPE and wasting money, and delays and non-compliances on projects. The PPE record keeping examples below highlight how the flow of PPE record keeping information dictates how well a company can keep up with what is going on. But one area where many companies still struggle when it comes to PPE is in PPE record keeping.

You are unable to access allacronyms.com

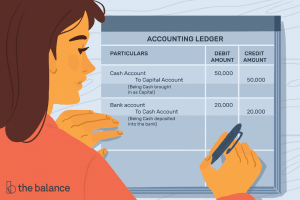

The balance of the PP&E account is remeasured every reporting period, and, after accounting for historical cost and depreciation, is called the book value. This means that if a company does not purchase additional new equipment (therefore, its capital expenditures are zero), then Net PP&E should slowly decrease in value every year due to depreciation. Property, plant, and equipment assets are also called fixed assets, which are long-term physical assets. Industries that are considered capital-intensive have a significant amount of fixed assets, such as oil companies, auto manufacturers, and steel companies. Even substantial PPP loans may not be enough money to help some small businesses survive in the long term.

The program is only intended to cover payroll costs for eight weeks, and it remains unclear how long many businesses will remain shuttered or otherwise limited amid the COVID-19 outbreak. Through the PPP, businesses with up to 500 employees (and some other companies) can receive a loan for 2.5 times their monthly payroll costs, up to $10 million. The loan can be forgiven if businesses use at least 75% of the forgiven amount for payroll, and if the money is used for payroll, interest on mortgages, rent and utilities. In response to the Coronavirus (COVID-19) pandemic, small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000. This advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. If a business received an Economic Injury Disaster Loan advance in addition to a Paycheck Protection Program (PPP) loan, the amount of the Economic Injury Disaster Loan advance will be deducted from the PPP loan forgiveness amount by SBA.

To help employees take advantage of the new rules, « you will need to put together a suitable communications campaign, » Gray and Paley suggested. « If you have already closed the run-out period for submitting 2020 claims, you will need to reopen that run-out period. » Take Facebook as an example of a tech company that has been scaling up their PPE investments. Let’s take two examples of big businesses in the S&P 500 that have very different business structures but the same end market. This website is using a security service to protect itself from online attacks.

Property Plant and Equipment Schedule Template

The same goes for real estate companies that hold buildings and land under their assets. Their office buildings and land are PP&E, but the houses or land they sell are inventory. As tax-deductible expenses, the amounts paid for PPE are also eligible to be paid or reimbursed under health flexible spending accounts (health FSAs), health savings accounts (HSAs) or health reimbursement arrangements (HRAs). However, if an amount is paid or reimbursed under a health FSA, HSA, HRA or any other health plan, it is not deductible for tax purposes. Proper management of capital expenditures is crucial to the growth and profitability of a company, so much so that investors analyze how a company manages its PP&E to determine if its capital expenditures will aid its success or be a drain on its funds. Tangible assets are depreciated for accounting purposes whereas intangible assets are amortized.

Navigating opportunity in the US personal-protective-equipment … – McKinsey

Navigating opportunity in the US personal-protective-equipment ….

Posted: Fri, 19 Feb 2021 08:00:00 GMT [source]

Property, plant, and equipment (PP&E) are long-term assets vital to business operations. Property, plant, and equipment are tangible assets, meaning they are physical in nature or can be touched; as a result, they are not easily converted into cash. The overall value of a company’s PP&E can range from very low to extremely high compared to its total assets. Property, plant, and equipment (PP&E) are the long-term, tangible assets that a company owns.

What Classifies as Property, Plant, and Equipment?

In May 2017, Factory Corp. owned PP&E machinery with a gross value of $5,000,000. Due to the wear and tear of the machinery, the company decided to purchase another $1,000,000 in new equipment. For this period, the depreciation expense for all old and new equipment is $150,000. The account can include machinery, equipment, vehicles, buildings, land, office equipment, and furnishings, among other things. Note that, of all these asset classes, land is one of the only assets that does not depreciate over time. I’d also like to note that the PPE table outlines the accumulated depreciation, representing the portion of PPE in the balance sheet that has already been depreciated.

The scale, lifecycle and frequency of PPE use makes it a bit of a logistical nightmare. Most companies and workers have become very competent in ensuring that everyone on site or in the workplace has the PPE they need to get their job done safely. They have also become increasingly at many other aspects of PPE management and enforcement.

They are often linked (the request comes before the issue), but sometimes PPE needs to be issued because it has expired, because teams have expanded etc. etc. Investment analysts and accountants use the PP&E of a company to determine if it is on a sound financial footing and utilizing funds in the most efficient and effective manner. Separately, the IRS delayed until May 17 the deadline to make 2020 prior-year contributions to HSAs and other individually owned tax-advantaged accounts (see the box below).

Where to Find Depreciation / PPE in a 10-k

Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission. To request permission for specific items, click on the “reuse permissions” button on the page where you find the item. It’s important to know where a company is allocating its capital, whether the company is making capital expenditures, and how the company plans to raise the capital for its projects. Depreciation also helps spread the asset’s cost out over a number of years allowing the company to earn revenue from the asset. I find it interesting that we are on the cusp of these huge FANG stocks, now thought of as big tech, becoming hugely capital intensive business. We might imply from this that the company doesn’t seem to be involved with aggressive internal expansion, and there also probably won’t be much in the way of earnings surprises from creative PPE depreciation accounting.

Bournemouth director sentenced for supplying illegal security – GOV.UK

Bournemouth director sentenced for supplying illegal security.

Posted: Thu, 29 Jun 2023 07:00:00 GMT [source]

He estimated that covering all payrolls for businesses with fewer than 500 employees would take about $600 billion, assuming every single firm borrowed the maximum possible amount. On Friday, President Trump signed into law a measure refunding the PPP program with $310 billion in additional lending authority. The fresh funding round means small business owners like Petersen will have a second chance at getting a loan that could help them keep their companies afloat, and, crucially, pay the people who were counting on her. Current assets are short-term, meaning they are items that are likely to be converted into cash within one year, such as inventory. Benefit account participants, however, « can submit manual claims with appropriate receipts, » he pointed out. « The receipts should clearly specify the items that were purchased for the expense to be eligible for reimbursement. »

What Are Noncurrent Assets?

Fixed assets have a useful life assigned to them, which means that they have a set number of years of economic value to the company. Fixed assets also have a salvage value, which is the value remaining at the end of the asset’s life. This should give us a good representation on either end of PPE light or PPE heavy balance sheets, for illustrations of different capex requirements, depreciation, and general PPE accounting. Some experts also say that PPP is less helpful for extremely small businesses with only a few employees, especially if they spend more on costs like rent rather than payroll. Hamilton adds that he believed from the beginning that the PPP’s initial $349 billion in funding would be insufficient.

Depreciation helps a company avoid a significant cash outlay in the year the asset is purchased. In updated guidance published April 23, the SBA emphasized that companies that apply for PPP loans must certify that they have a real need for the money. The general rule in accounting for repairs and replacements is that repairs and maintenance work are expensed while replacements of assets are capitalized.

These purchases are called capital expenditures and significantly impact the financial position of a company. Whether a portion of available cash is used, or the asset is financed by debt or equity, how the asset is financed has an impact on the financial viability of the company. PP&E is recorded on a company’s financial statements, the rules of working with tax returns for unexperienced accountants specifically on the balance sheet. To calculate PP&E, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. In most cases, companies will list their net PP&E on their balance sheet when reporting financial results, so the calculation has already been done.

But experts say she and other small business owners left out of the first round would be wise to try again — and the sooner they act, the better their odds of receiving help may be. The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid. The SBA’s Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic.

But the program, which was signed into law as part of the CARES Act on March 27, ran out of money startlingly quickly, before Petersen and many like her saw even a dime. PP&E are assets that are expected to generate economic benefits and contribute to revenue for many years. The easiest way to keep track of fixed capital assets is with a schedule, such as the one shown below. This is the type of analysis a financial analyst would prepare and maintain for a company in order to prepare complete financial statements or build a financial model in Excel. Property, Plant, and Equipment (PP&E or PPE) is a term used in accounting for assets and property that cannot easily be converted into cash.

While most fixed assets depreciate over time and are not easily converted to cash, some assets such as real estate can increase in value over time, providing a company with a possible option for raising cash. Steven Hamilton, assistant professor of economics at The George Washington University, says it’s difficult to say ahead of time whether the changes in the second round will actually make it easier for small businesses to get PPP loans. But, he says, “it can’t hurt.” He adds that, now that companies with more clout have already received PPP loans, there’s reason to believe the next round will go to smaller, less connected firms. However, land is not depreciated because of its potential to appreciate in value.