Content

It would be reported in the non-operating and other section because it doesn’t have anything to do with sales. The Multi-Step Income Statement is a useful multi-step financial statement.

- An income statement is one of the most basic but necessary accounting documents for any company.

- Lastly, you can see the non-operating and other section being subtracted to compute the net income.

- On the other hand, some investors may find single-step income statements to be too thin on information.

- You can also include taxes in this section, or if you’re looking to create EBIT , you can create a separate section for taxes.

- It’s an alternative to the single-step income statement that allows users of the statement to better determine the profitability of the company and how much of it is contributed by the core operations.

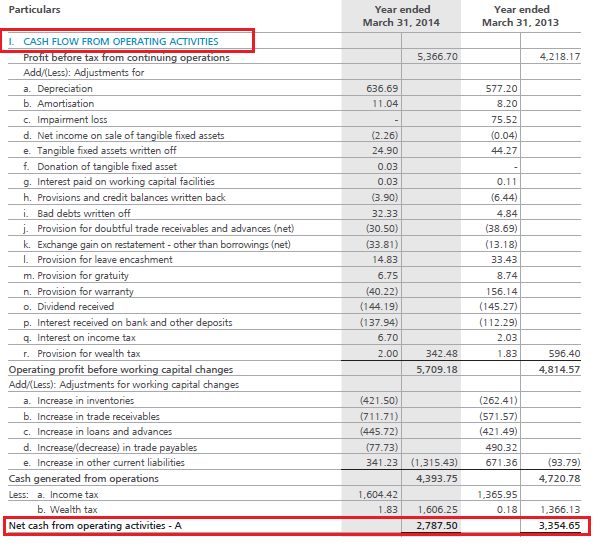

Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. While these statements provide different insights, they are both used by investors and lenders to make decisions about your business. Read the income statement from top to bottom, the line items are placed in logical Prepare a Multiple Step Income Statement order. For instance, if you’re applying for a loan, the bank may wish for you to have formatted your income statement in a particular way. The right financial statement to use will always depend on the decision you’re facing and the type of information you need in order to make that decision. Cash Flow From Operating Activities indicates the amount of cash a company generates from its ongoing, regular business activities.

Prepare A Multiple Step Income Statement That

When calculating gross profit, no other expenditures are included apart from the cash inflow from the sale of goods and cash outflow from the purchase of goods. The single-step income statement is the simplest income statement format, calculating revenue totals and subtracting expenses to arrive at net income. For any company to be profitable , its gross profit must be greater than its selling, general and administrative expenses and nonoperating items such as interest expense. Operating expenses are expenses that relate to the main income statement, and they include items such as general administrative costs, selling, and distribution expenses. M _____________ ___________ consist of various revenues and expenses and gains and losses that are unrelated to the company’s main line of operations.

In other words, sales are generally the main operating revenues for companies selling goods. Typically, those who produce or sell goods use multiple-step income statements because there is a greater need to understand the differences between operating and non-operating transactions. Examples of these types of businesses include manufacturers and retailers.

Preparation Time

For instance, a retailer is not into the insurance business, and a car hits their store. The insurance company paid an amount out of the settlement so that proceeds received from the insurance company will not be considered in total sales; rather, it will be a non-operating income. From an accounting perspective, a drawback of the multi-step income statement is that it takes much longer to prepare than a single-step statement. Not only is each category of income separated, but within each category, the statement provides a detailed list of major sources of revenue and expenses. This means more time spent analyzing financial data and putting it into the statement. International Note The IASB and FASB are involved in a joint project to evaluate the format of financial statements.

The multi-step income statement may seem a bit intimidating at first, but it really is a useful topic to explore. To prepare a cash flow statement, you’ll first need to determine which method—direct or indirect—is used to display financial information. Once your method is selected, you’ll need specific information from the income statement, balance sheet, accounts, or journal entries, depending on your method. A balance sheet and income statement differ in many ways, including the information included in each report, the calculations, the time frame, and how each statement is analyzed. For example, an income statement will show if a company has the revenue to cover its expenses, and the balance sheet tells whether or not a company is creditworthy. However, the multi-step approach can still yield misleading results if management alters where expenses are recorded in the statement. For example, an expense may be shifted out of the cost of goods sold area and into the operating expenses area, resulting in a presumed improvement in the gross margin.

You don’t need to separate operating expenses from the cost of sales. Yet, a single-step income statement could still provide all of the information a small business would need to see how it is doing. A single-step income statement will be easier for a small business to prepare, which could be an important consideration for some small businesses. A single-step income statement does not separate revenue or expenses into operational and non -operational categories. For the single-step income statement, one equation is used to calculate the net income or the net loss. Next, we will subtract cost of goods sold from sales revenues to arrive at gross profit.

Selling, General And Administrative Expenses

It is more common for businesses to use the multiple-step income statement because it provides greater detail on the statement and highlights the company’s overall operating efficiency. The total operating expense of the business stands at $19,000, and thus to arrive at the operating income, we deduct the operating expense from the gross profit to arrive at a value of $131,000.

And the Company’s Operating income is calculated by deducting these total operating expenses from the gross profit in the first section. The next step is to subtract the total of your operating expenses from your gross profit in order to arrive at operating income. Operating income measures the amount of income from operations excluding all non-operating income and expenses. Since the company is not in the business of selling long-term assets, the amount received is not included in its operating revenues. Instead, only the gain or loss on the sale is shown on the income statement after the operating income.

Step 2: Title The Statement

The single-step income statement is an easy way to see the profit or loss of your business in an easy-to-understand format. Non-operating head covers revenues and expenses that are not directly related to the primary business activities.

- To calculate net income, you will need to add your operating income with any positive and negative non-operating items.

- Several steps are involved in preparing this type of income statement.

- Multiple-step income statements are used by most publicly-traded companies.

- The multiple-step income statement details both operating and nonoperating expenses, providing a better disclosure of the company’s operating stability.

- One of the biggest differences between a single-step income statement and a multi-step income statement is the ability to calculate gross profit.

- In reality, that equipment is going to last longer than 24 months, which means the depreciation expenses on the income statement are not always a true reflection of the costs that are incurred.

It is usually known as a Trading Account, where Direct Incomes and Expenses are mentioned. All the revenues are combined under one main head, i.e., income listing and all the expenditures are put together under Expenses head. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Neil Kokemuller has been an active business, finance and education writer and content media website developer since 2007.

What Is The Difference Between Net Revenue & Operating Income?

Therefore, it is critical for the cost of the items sold to be calculated accurately. Typically, multi-step income statements are used by larger businesses with more complex finances. However, multi-step income statements can benefit small businesses that have a large variety of revenue streams.

Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase. Each individual’s unique needs should be considered when deciding on chosen products. However, it calculates the net income or net loss for the business by using three equations instead of one. There are no sub-categories in the non-operating head as they were under the operating head.

The cost of goods sold gets subtracted from net sales, resulting in gross profit. The income statement becomes the foundation for a forecast of future accounting periods. One clear advantage of the single-step format is that it’s an easy statement to prepare. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales, to make analysis easier.

- It’s always important to view comparative financial statements over time, so you can see trends and possibly catch misleading placement of expenses.

- A simple income statement combines all revenues into one category, followed by all expenses, to produce net income.

- This might include losses from an investment that is not performing well or payments made on lawsuits or legal fees.

- The formula for gross profit takes into account only the amounts relating the actual selling and production for the company.

- If the asset had a book value of $15,000 and the company received $10,000 the company will report loss on sale of equipment of $5,000.

- Income statements, also called profit and loss statements, are one of the major financial statements prepared by businesses.

In this case, a reader might draw incorrect conclusions from the altered presentation of information. Consequently, when such a change is made, the nature of the change should be described in the footnotes that accompany the financial statements. The multi-step income statement shows important relationships that help in analyzing how well the company is performing. For example, by deducting COGS from operating revenues, you https://accountingcoaching.online/ can determine by what amount sales revenues exceed the COGS. If this margin, called gross margin, is lower than desired, a company may need to increase its selling prices and/or decrease its COGS. The classified income statement subdivides operating expenses into selling and administrative expenses. Thus, statement users can see how much expense is incurred in selling the product and how much in administering the business.

Note that any sales discounts and allowances are also subtracted from sales revenues in this section. The income statement shows the total revenue attributable to the primary activities of the business, excluding revenues from non-merchandise-related sales. Investors also use the gross profit to determine the profitability of primary business activities and the general health of the company.

The multistep income statement gives far more detail than the single step statement, but it can also be more misleading if not prepared correctly. For instance, management might shift expenses out of cost of goods sold and into operations to artificially improve their margins. It’s always important to view comparative financial statements over time, so you can see trends and possibly catch misleading placement of expenses.

The income statement for a merchandiser is expanded to include groupings and subheadings necessary to make it easier for investors to read and understand. We will look at the income statement only as the other statements have been discussed previously. It is an important figure for the creditors, investors, and internal management as it depicts how profitable a company is at selling the goods or making the products. If you’re a sole proprietor, freelancer, or consultant, a single-step income statement is sufficient.

Which Income Statement Format Do I Choose?

A multi-step income statement gives the details of the operating expenses and operating revenues as well as the non-operating expenses and revenues. The first step to creating the statement is gathering the necessary information. The adjusted trial balance is a listing of the company’s accounts and their balances after adjusting journal entries have been made.