Оглавление:

Не хотите рисковать в торговле на Forex огромными суммами? Тогда вкладывайтесь по минимуму, в этом вам поможет статья «Как открыть центовый счет на Форексе». Если вы решили покорять вершины валютного рынка, не стоит ждать. Советуем прочитать нашу познавательную статью «Как открыть реальный счет Форекс на Метатрейдере 4», чтобы начать эту деятельность грамотно. А для тех, кто планирует торговать по-настоящему, нужен реальный торговый счет.

Ни пополнять депозит, ни проходить верификацию не нужно. Во-первых, вы не получите финансовой выгоды, во-вторых, привыкнете не отвечать за потери. Без демо-аккаунта не обойтись новичкам, ведь перед полноценным трейдингом нужно научиться правильно им заниматься, отточить навыки. Если вы новичок, то на старте можете не справиться с эмоциями и сделать что-то не так. К тому же у вас элементарно может не хватать знаний рынка.

Сразу переходить к Как открыть центовый счет на форексе с реального аккаунта рискованно. Лучше начать с демонстрационного варианта, о нем вы можете прочитать в нашей статье «Что такое демо-счет на Форексе». Могут ли технические индикаторы предсказывать дальнейшее движение стоимости актива?

Любое копирование запрещено без разрешения администрации. Правильный выбор брокера позволит избежать проблем и получить неплохую прибыль в будущем. Возможность экспериментирования и поиска лучших валютных инструментов для трейдера.

Тестирование и использование советников

Но какой вы би ни выбрали, процесс открытия от этого почти не изменится. После заполнения и отправки, придет ответ на электронную почту. В нем будет номер счета, а также инструкция, как пополнить баланс. Так вот, именно у брокеров его и нужно открывать. Эти компании будут выполнять функцию своеобразных операторов или посредников. Рассказываем, какие шаги надо пройти, в чем разница между разными вариантами счетов и как определить самый оптимальный для себя.

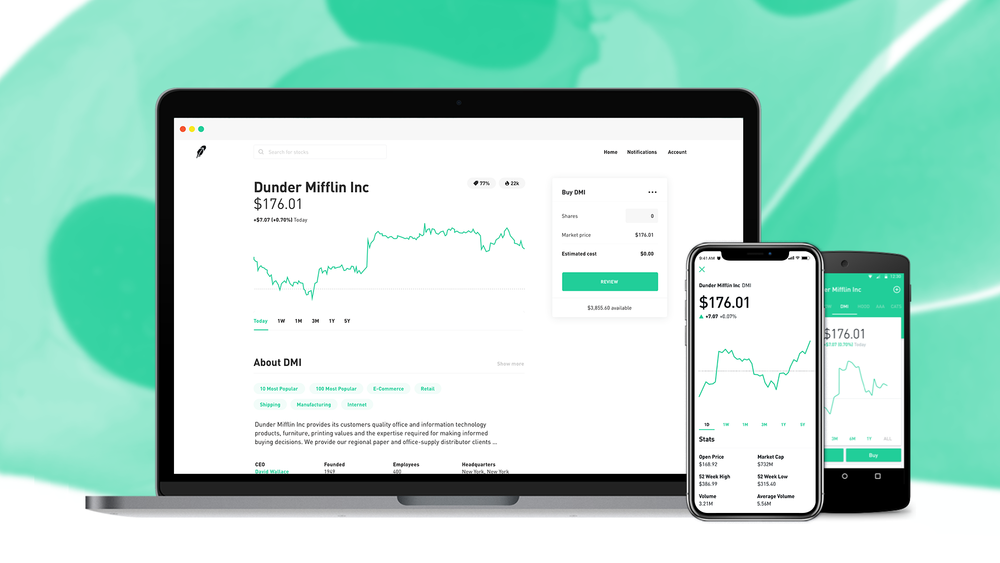

Если счет центовый, то сумма будет указана как 1000 центов. Для начала скажем, что это абсолютно бесплатный терминал, с помощью которого трейдеры со всего мира зарабатывают на Форексе. Им можно пользоваться как с компьютеров и ноутбуков, так и с планшетов и смартфонов.

- Предоставляет множество возможностей, инструментов и обширный выбор счетов для торговли.

- Этот брокер лучший выбор для центовых счетов – совет от владельца портала!

- Часто ими пользуются те, кто решил использовать в работе торгового робота.

- Благодаря минимизации рисков это отличный вариант для новичков.

Благодаря использованию минимального количества инвестиций, влияние ценовых колебаний валютных пар на депозит минимально. За счет этого миллионы людей смогли торговать на бирже с небольшим капиталом. Отметим, что данный способ торговли не принесет много прибыли сразу, так как ставки будут небольшими.

Является одним из лучших среди брокерских компаний. Предоставляет несколько видов центовых счетов. Одним из главных преимуществ, почему стоить открыть на Форекс центовый счет — отображение баланса не в целых долларах, а в его долях − центах. Это поможет новичку привыкнуть к «большим» суммам и сделает работу легче при использовании стандартного торгового счета. Поэтому трейдеры предпочитают не держать свои сделки открытыми более суток, чтобы вовремя поймать изменение рыночной тенденции и успеть закрыть свою сделку.

Открытие центового счета: преимущества использования сервиса

Чтобы зарабатывать на валютном рынке, первое, что нужно сделать – выбрать брокерскую компанию. Именно брокер будет оператором между трейдером и Forex. Бывает, что в течение дня цена меняется на 100 и даже несколько сотен пунктов. То есть, депозит размером в 100 долларов будет выглядеть как 10000с.

- Допустим, что именно этого брокера вы выбрали для торговли на Forex.

- Это отличная возможность для тех, кто только начинает свое знакомство с Forex (вся правда о форекс).

- Они могут называться по-разному, но объединяет их одно – в расчётах по ним используются центы в качестве единиц базовой валюты.

- Лучше начать с демонстрационного варианта, о нем вы можете прочитать в нашей статье «Что такое демо-счет на Форексе».

Тестирование технических индикаторов пользователя. Позволяет понять работу советников и стратегий. В большинстве случаев это подходит профессиональным трейдерам, которые торгуют на стандартных счетах. А раз больше объем сделки, значит и потенциальная прибыль тоже. Правда, при использовании кредитного плеча возможные потери тоже выше, чем без него. Мы уже знаем, что мини-лот – это 10 тысяч единиц валюты.

Сколько торговать

Но дробные лоты могут использовать и опытные игроки. Например, чтобы опробовать торговую стратегию. Мы составили таблицу, в которой вы можете увидеть, как меняются прибыль и убытки в зависимости от того, какой именно у вас депозит.

Для тех, кто хочет добиться успехов на Форексе, центовый аккаунт необходим. Теперь перейдем к варианту, когда такой тип аккаунта использует новичок. Например, если речь идет об опытном трейдере, который применял его для тестирования новой стратегии или торговой идеи, то этот срок должен определить сам игрок. Это сумма, которая необходима для открытия сделки.

https://forex-helper.ru/ пункта может составлять всего 0,1 цента, что обезопасит ваш депозит даже в случае сильного изменения стоимости валютной пары. Его стандартный размер – 100 тысяч единиц валюты. Например, для пары USD/CAD это 100 тысяч долларов США.

Рассказываем, как торговать на минутных графиках с помощью индикаторов Parabolic SAR, Commodities Channel Index и EMA, которые составляют стратегию скальпинга. Приводим примеры покупки и продажи по стратегии « Скальпинг Parabolic SAR + CCI ». DraftKings Inc., акции которой торгуются на NASDAQ, является одной из крупнейших компаний на рынке онлайн-ставок на спорт. За 2021–2022 года она увеличила свою выручку на 190%, до 473 млн USD.

Топ-3 перспективные акции ритейлеров США

Многие относятся к Форекс с опасением из-за высоких ставок или величины депозита. Кроме демо-счета, где можно попробовать свои силы, у многих брокеров доступна еще одна услуга — открытие центового счета. Это отличная возможность для тех, кто только начинает свое знакомство с Forex (вся правда о форекс). Давно стал одной из ведущих брокерских компаний.

Проверка индикаторов или советников Форекс с минимальными затратами. Проверка работы брокера и предоставляемого качества услуг. Изучение и отработка системы манименеджмента во время планирования и открытия сделок. Обучение способам торговли с минимальным уровнем затрат, рисков и издержек. Принять участие в бонусных программах для начисления начального депозита. Чтобы не тратить время на поиски брокерской компании, советуем остановиться на ИнстаФорекс.

Депозит придется пополнять настоящими деньгами, прибыль и убытки в этом случае тоже будут настоящими. Но при всех очевидных преимуществах не стоит забывать о том, что центовый аккаунт не принесет большой прибыли. Кроме этого, трейдер может привыкнуть к тому, что рискует центами, а не долларами, и перенести потом этот торговый стиль на классическую торговлю. Однако стоит помнить, что нежелательно подолгу останавливаться на торговле на центовом форекс счете, лучше постепенно переходить на следующую ступень. Из-за незначительных рисков «застоявшийся» трейдер может потерять так называемую «психологию торговли», не вовремя перейдя на операции с реальными или более крупными суммами.

К настоящему времени, благодаря активному развитию компаний-брокеров, ситуация кардинально противоположная. Выйти на рынок Форекс можно даже с $10, открыв тип счета «cent». Для начинающих трейдеров может быть не совсем понятно, что такое центовый счет, для чего он существует и кому предназначен.

Сколько должно составлять это превышение и в течение какого периода наблюдаться – решать игроку. Как долго нужно пользоваться аккаунтом в центах? Когда позиция закрыта, остается лишь зафиксировать прибыль или убыток. Помним о том, что в нашем случае они исчисляются в центах. А чтобы соблюдать правила риск-менеджмента, в распоряжении нужно было иметь еще более солидную сумму. Понятно, что такие рамки ограничивали доступ к валютному рынку для многих трейдеров.

Открыть центовый счет Альпари

Мини-Форекс – это не самая минимальная планка. Есть еще микро-лоты, о них читайте в статье «Микро-счет Форекс». Получается, мини-вариант Форекса можно рассматривать как первую ступеньку на пути к большим сделкам. И доходы тоже будут меньше, чем в случае со стандартными лотами.

Сразу хотим обратить ваше, что не все брокеры дают возможность открыть центовые счета, им это не очень выгодно из-за маленьких ставок. Cent Forex – торговый счет Форекс, на котором, как можно понять из названия, баланс и все операции отображаются в меньшей валюте. Благодаря этому работа не будет такой рисковой. Отличный вариант для новичков или тех трейдеров, кто хочет попробовать новые стратегии.

Например, копировать сделки успешных игроков или присоединиться к ПАММ-системе. На рынке бывают периоды, когда не происходит активного движения стоимости в одном или другом направлении. Такие периоды называются консолидация в трейдинге, также можно их назвать флетом. А если стоимость упадет на 10 пунктов, потери будут тоже равняться 100 центам ($1). Главное – чтобы прибыль от успешных сделок перекрывала убыток от проигрышных.